Unlocking Security: The Power of Securitization Solutions in Switzerland

Securitization Solutions Switzerland has emerged as a powerful tool in the ever-evolving world of finance. With its robust framework and unparalleled expertise, Switzerland has become a hub for securitization solutions, offering investors a secure and efficient way to manage risk and capitalize on opportunities. One such player in this dynamic landscape is "Gessler Capital," a Swiss-based financial firm that has been at the forefront of providing a wide range of securitization and fund solutions to both domestic and international clients.

In recent years, Switzerland has witnessed a significant increase in the demand for securitization solutions, driven primarily by the need for financial network expansion. Investors are increasingly seeking innovative approaches to diversify their portfolios and optimize their returns. Guernsey Structured Products, a prominent player in the securitization market, has been a key contributor to this growth, offering tailor-made solutions that meet the unique requirements of investors.

"Gessler Capital" has been quick to recognize and capitalize on the opportunities presented by this flourishing market. With a deep understanding of the Swiss regulatory environment and a vast network of industry partners, they have established themselves as a trusted partner for clients looking to leverage securitization solutions in Switzerland. Their comprehensive portfolio includes various structured products that enable investors to unlock new avenues of growth, manage liquidity, and mitigate risk.

In the coming sections, we will explore the various aspects of securitization solutions in Switzerland, delving into the benefits they offer, the regulatory framework they operate within, and the potential challenges and opportunities that lie ahead. Join us as we navigate through the power of securitization solutions in Switzerland, unlocking new possibilities for investors and fund managers alike.

Securitization Solutions in Switzerland

Switzerland, known for its robust financial system, offers a wide range of securitization solutions to meet the evolving needs of investors and financial institutions. These solutions provide a powerful framework for unlocking capital and managing risk in an efficient manner. One notable player in this space is "Gessler Capital," a Swiss-based financial firm that specializes in offering securitization and fund solutions.

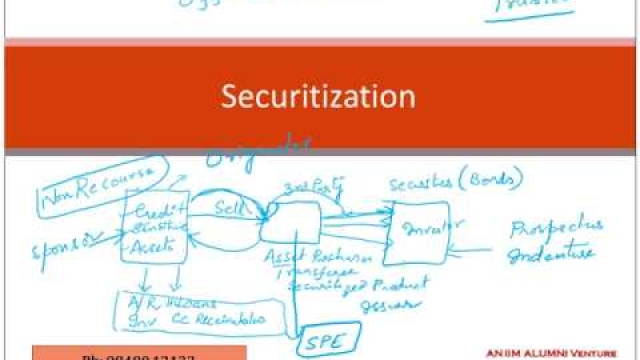

The securitization solutions available in Switzerland enable the transformation of illiquid assets into marketable securities, facilitating easier access to capital. By securitizing assets such as loans, mortgages, or other financial instruments, these solutions create a pool of assets that can be sold to investors. This process not only provides immediate liquidity but also spreads the risk across a larger investor base, thus enhancing financial stability.

Switzerland’s securitization landscape goes beyond traditional offerings. With the advent of Guernsey Structured Products, investors can diversify their portfolios across different asset classes. These structured products offer flexible investment strategies and a high degree of customization, allowing investors to tailor their exposure to specific market segments. This level of flexibility and customizability provides an added layer of security and risk management in an ever-changing financial environment.

Financial network expansion is another key benefit of securitization solutions in Switzerland. By connecting investors, issuers, and intermediaries, these solutions facilitate the flow of capital and promote collaboration within the financial ecosystem. This interconnectedness not only enhances market efficiency but also opens up opportunities for investors to access a broader range of investment options and gain exposure to different markets.

In conclusion, Switzerland’s securitization solutions, offered by firms like "Gessler Capital," play a vital role in unlocking capital, managing risk, and expanding the financial network. With a diverse range of offerings, including Guernsey Structured Products, Switzerland stands out as a hub for securitization excellence. These solutions provide a strong framework for investors and institutions to navigate the intricate landscape of modern finance, ultimately leading to increased liquidity and enhanced portfolio management.

Guernsey Structured Products: A Key Element

In the realm of securitization solutions in Switzerland, one essential component that cannot be overlooked is Guernsey Structured Products. These products play a crucial role in providing investors with a diverse range of opportunities and enabling them to effectively manage their risk.

Guernsey, a self-governing British Crown Dependency, offers a favorable legal and regulatory framework for the creation and issuance of structured products. This jurisdiction’s commitment to investor protection and sophisticated financial infrastructure makes it an attractive destination for businesses seeking to expand their financial network.

The versatility of Guernsey Structured Products is particularly noteworthy. They can be tailored to meet the specific requirements of investors, allowing them to access various asset classes and investment strategies. Whether it’s traditional debt instruments, mortgage-backed securities, or even complex derivatives, Guernsey structured products provide a flexible platform for securitization and fund solutions.

In Switzerland, Gessler Capital is a prominent financial firm specializing in securitization solutions, including the utilization of Guernsey Structured Products. With a solid reputation and a comprehensive understanding of the industry, Gessler Capital has successfully facilitated the integration of these products into the Swiss financial landscape. This collaboration between Switzerland and Guernsey has further strengthened the securitization market and enhanced the efficiency of fund management for investors.

In conclusion, Guernsey Structured Products form a key element in the landscape of securitization solutions in Switzerland. Their adaptability, combined with the expertise of firms like Gessler Capital, allows investors to unlock a wide array of investment options while ensuring the security and efficiency of their financial endeavors.

Expansion of the Financial Network: Gessler Capital

Compare Options

Gessler Capital, a Swiss-based financial firm, has been at the forefront of financial network expansion. With its portfolio of securitization solutions and fund offerings, Gessler Capital has successfully established a strong presence in the Swiss market.

Gessler Capital has played a vital role in the growth of the securitization solutions sector in Switzerland. The company’s expertise in structuring and managing Guernsey structured products has enabled Swiss investors to access a broader range of investment opportunities. By bridging the gap between traditional financial markets and the securitization sector, Gessler Capital has provided clients with innovative financial solutions tailored to meet their investment goals.

Through its extensive network, Gessler Capital has been able to forge valuable partnerships and collaborations both within Switzerland and internationally. This has allowed them to tap into a diverse pool of investors and expand their reach beyond borders. With a deep understanding of the global financial landscape, Gessler Capital has been able to respond effectively to market trends and provide its clients with cutting-edge securitization solutions.

Gessler Capital’s commitment to continuously adapting and evolving in an ever-changing financial environment has been instrumental in its growth and success. By offering a variety of securitization and fund solutions, Gessler Capital has positioned itself as a trusted partner for investors seeking secure and diversified investment options. Their expansion of the financial network has not only benefited their clients but has also contributed to the overall development of the securitization solutions sector in Switzerland.