Demystifying Business Tax: Unlocking Efficiency and Maximizing Savings

Welcome to our comprehensive guide on the ins and outs of business tax! In the complex world of finance, understanding your tax obligations is crucial for unlocking efficiency and maximizing savings. Whether you are a small business owner just starting out or an established company looking to optimize your financial strategies, this article will provide you with the essential knowledge to navigate the labyrinth of business tax.

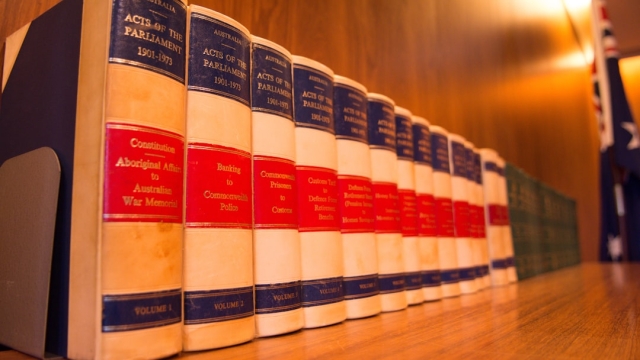

As the saying goes, "knowledge is power," and when it comes to taxes, it couldn’t be truer. The Business Tax Law Guide is your ultimate companion in demystifying the intricate rules and regulations surrounding business taxes. Armed with this invaluable resource, you’ll gain a deeper understanding of the tax code and how it specifically applies to your business.

Furthermore, our Business Finance Guide will shed light on the importance of bridging the gap between financial decision-making and tax planning. A well-structured financial strategy that integrates tax considerations can not only minimize your tax liability but also optimize your overall business performance. By taking a proactive approach to tax planning, you can effectively optimize your cash flow, manage risks, and ultimately improve your bottom line.

So, whether you’re looking to navigate the labyrinth of tax deductions, understand the nuances of different tax forms, or explore opportunities for tax credits and incentives, this article will provide you with the insights you need to demystify business tax and unlock its full potential. Let’s dive in and unravel the world of business tax with precision and clarity.

Understanding Business Tax Deductions

When it comes to managing business taxes, understanding deductions is key to maximizing savings. Deductions allow businesses to reduce their taxable income, ultimately lowering the amount they owe in taxes. In this section, we will delve into the world of business tax deductions and explore the various types available to help you unlock efficiency in your tax planning.

One common type of deduction is the business expenses deduction. This encompasses a wide range of costs that are necessary for operating your business. Examples of deductible business expenses may include office rent, utilities, employee salaries, and advertising expenses. By carefully documenting and deducting these expenses, you can significantly lower your taxable income.

Another important deduction to consider is the depreciation deduction. This deduction allows you to recover the cost of certain assets used for your business over time. Assets like buildings, vehicles, machinery, and equipment can lose value over their useful lifespan, and the depreciation deduction allows you to account for this decrease in value. By taking advantage of this deduction, you can gradually deduct a portion of the asset’s cost each year, providing tax savings in the long run.

Additionally, businesses can benefit from deductions related to employee benefits and contributions. Expenses such as health insurance premiums, retirement plan contributions, and employee education assistance can often be deducted. These deductions not only help reduce your tax liability but also demonstrate your commitment to your employees’ well-being and professional growth.

Understanding business tax deductions is crucial for optimizing your tax strategy. By taking advantage of the various deductions available, you can unlock efficiency in your business tax planning, maximize savings, and ensure compliance with the tax laws governing your operations. Stay tuned for the next sections where we will explore additional aspects of business tax and how you can navigate the complex world of tax regulations to your advantage.

Navigating Changes in Tax Laws

The world of business tax is constantly evolving, with tax laws undergoing regular changes that can have a significant impact on businesses. Staying up to date with these changes is crucial to ensuring compliance and maximizing tax savings. In this section, we will explore some key strategies for navigating changes in tax laws effectively.

1. Stay Informed

As a business owner, it is important to stay informed about any changes in tax laws that could affect your business. This can be done by regularly reading government publications, consulting with tax professionals, and attending tax seminars or workshops. By staying informed, you can proactively adapt your tax strategies to any new regulations, maximizing your tax efficiency and minimizing the risk of penalties or audits.

2. Consult with a Tax Professional

Navigating the complex world of tax laws can be challenging, especially for small business owners who may not have the expertise or time to keep up with the constant changes. Consulting with a tax professional can provide valuable insights and advice on how to navigate these changes effectively. A tax professional can help you understand the new regulations, identify potential tax savings opportunities, and ensure compliance with the law.

3. Review and Update Your Tax Strategy

With changes in tax laws, it is essential to review and update your tax strategy regularly. What may have worked in the past may no longer be the most optimal approach under the new regulations. By reviewing and updating your tax strategy, you can identify areas where savings can be maximized and ensure that your business remains in compliance with the latest tax laws.

By following these strategies for navigating changes in tax laws, you can ensure that your business remains tax-efficient, maximizes savings, and avoids potential penalties. Remember, staying informed, consulting with tax professionals, and regularly reviewing and updating your tax strategy are key to successfully navigating the ever-changing world of business tax.

Strategies for Tax Planning and Savings

Deductions and Credits: One effective strategy for minimizing your business tax liability is to take advantage of deductions and credits that you may be eligible for. Deductions reduce your taxable income, while credits directly reduce the amount of tax you owe. Examples of common deductions and credits include business expenses, research and development credits, and energy-efficient property credits.

Structuring your Business: How you structure your business can also impact your tax obligations. Different business entities, such as sole proprietorships, partnerships, and corporations, have different tax rules and rates. By carefully considering the tax implications of each entity type, you can choose the one that best aligns with your tax planning goals and ultimately maximize your savings.

IRS 831b tax codeTiming of Income and Expenses: Timing is crucial when it comes to tax planning. You have the flexibility to defer income or accelerate expenses, depending on your specific circumstances. For example, if you expect higher income in the following year, you may choose to delay invoicing until then. On the other hand, prepaying certain expenses before the end of the tax year might allow you to deduct them in the current year, reducing your taxable income.

Retirement Plans: Establishing retirement plans not only helps you save for the future but can also provide significant tax advantages. Contributions made to retirement plans, such as SEP IRAs, SIMPLE IRAs, or 401(k) plans, are generally tax-deductible for the business. Additionally, earnings within the retirement plan are tax-deferred until withdrawn during retirement, potentially resulting in substantial tax savings.

Utilizing Tax Professionals: Navigating the complexities of business taxes can be challenging, especially if you are unfamiliar with the tax code and regulations. Seeking the guidance of qualified tax professionals, such as accountants or tax advisors, can help ensure that you are taking advantage of all available tax benefits and compliance with tax laws. They can provide valuable insights, identify potential risks, and help you optimize your tax planning strategies.

By implementing these tax planning strategies, businesses can unlock efficiency, maximize savings, and achieve greater financial success. Remember, tax planning should be an ongoing process that adapts to changes in your business and the ever-evolving tax landscape.