Safeguarding Your Sanctuary: Unraveling the Essence of Home Insurance

As we strive to create a place of comfort and security for ourselves and our loved ones, our homes become sanctuaries: a refuge from the chaos of the outside world. However, unforeseen events such as natural disasters, theft, or accidents can disrupt this sense of tranquility in an instant. This is where having home insurance can truly make a difference.

Home insurance serves as a protective shield, offering financial coverage against various risks that homeowners may face. Whether you are a new homeowner seeking to safeguard your investment or a long-time resident looking to reassess your current policy, this comprehensive guide to home insurance will provide you with valuable insights and help you make informed decisions to protect what matters most to you.

Throughout this article, we will delve into the intricacies of home insurance, unraveling its essence and significance. From understanding the basic concepts and coverage options, to exploring key factors like deductibles and premiums, we aim to equip you with the knowledge necessary to confidently navigate the world of home insurance. So join us as we embark on this journey to safeguard our sanctuaries, ensuring peace of mind in the face of uncertainties that may arise within the walls we call home.

Understanding Home Insurance Coverage

When it comes to protecting our homes, having the right insurance coverage is crucial. Home insurance provides financial security against unexpected events and disasters that may cause damage or loss to our valued sanctuary. In this section, we will delve into the intricacies of home insurance, guiding you through the key aspects that you need to understand.

First and foremost, home insurance offers coverage for the structure of your home. This includes protection for the physical building itself, as well as any attached structures such as garages or sheds. In the event of perils like fire, vandalism, or natural disasters, your home insurance will help cover the costs of repairs and restoration, ensuring that you can restore your dwelling to its previous state.

However, it’s not just the structure that is covered by home insurance. Your policy also encompasses your personal belongings within the house. From furniture to electronics, appliances to clothing, home insurance helps safeguard your possessions against theft, damage, or loss. Whether it’s a burglary or an accidental mishap, having the right coverage can provide you with the peace of mind that your belongings are protected.

Moreover, home insurance goes beyond just physical protection. It also extends liability coverage to homeowners. This means that if someone is injured on your property or if you accidentally cause damage to someone else’s property, your home insurance will step in to cover the costs of legal expenses, medical bills, or repairs. This liability coverage is invaluable as it shields you from potential financial burdens that could arise from unexpected accidents or mishaps.

Understanding home insurance coverage is vital for every homeowner. By comprehending the protection it offers to your physical dwelling, personal belongings, and liability exposure, you can make informed decisions to ensure your refuge remains safeguarded. In the next section, we will explore the different types of home insurance policies available, providing you with a comprehensive home insurance guide to help you choose the right coverage for your needs. Stay tuned!

Factors to Consider When Choosing Home Insurance

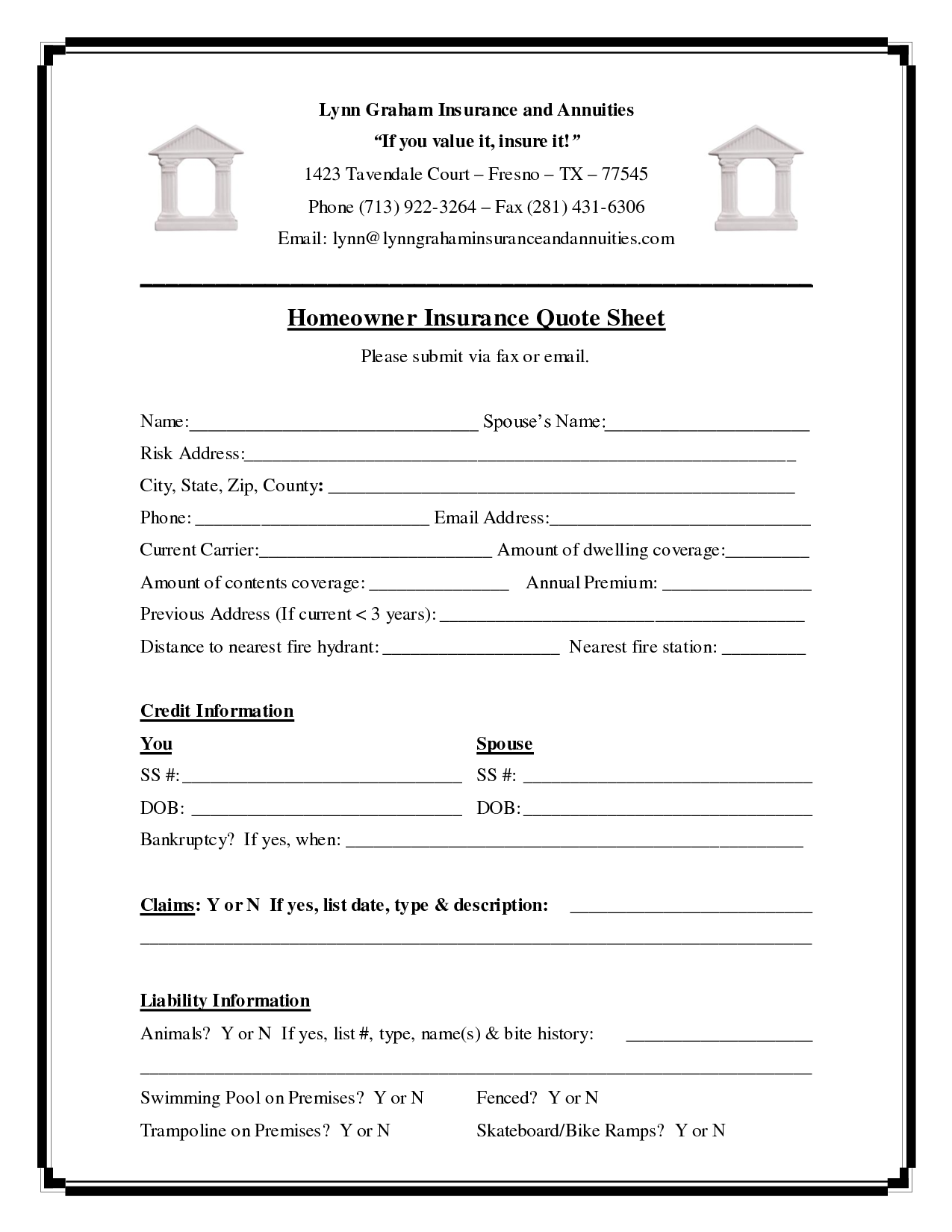

Coverage Options: When selecting home insurance, it is essential to carefully evaluate the coverage options offered by different insurance providers. Consider the specific needs of your sanctuary and ensure that the policy adequately protects your home and its contents. Look for coverage that includes protection against common risks such as theft, fire, vandalism, and natural disasters like floods or earthquakes. Assessing the coverage options allows you to find a policy that meets your unique requirements.

Reputation and Financial Stability: Another crucial factor to consider is the reputation and financial stability of the insurance company. Look for an insurer that has a strong track record of providing reliable and prompt services to policyholders. Research the company’s financial strength ratings and reviews to ensure that it has the financial capability to fulfill its obligations in case of a claim. A reputable and financially stable insurance provider will give you peace of mind knowing that your sanctuary is protected.

Customer Service and Claims Process: The level of customer service and the efficiency of the claims process are important considerations when choosing home insurance. Opt for an insurance company that has a reputation for excellent customer service, with agents who are knowledgeable and responsive to your inquiries. Additionally, review the claims process to ensure that it is straightforward and hassle-free. A proactive and efficient claims process will help you get back on your feet faster in the event of an unfortunate incident.

In conclusion, carefully considering coverage options, the reputation and financial stability of the insurance company, as well as the quality of customer service and claims process are essential when choosing home insurance. By focusing on these factors, you can ensure that your sanctuary is safeguarded with a reliable insurance policy.

Tips for Making a Home Insurance Claim

Promptly Notify Your Insurance Provider

When faced with a situation that requires making a home insurance claim, it is crucial to inform your insurance provider as soon as possible. This ensures that they are aware of the incident and can guide you through the claims process. Contact their designated claims department or customer service helpline to initiate the claim.

workers comp insurance MichiganDocument the Damage or Loss

To support your home insurance claim, it is essential to gather evidence of the damage or loss that occurred. Take photographs or videos of the affected areas or items, highlighting any visible destruction. Additionally, keep any receipts, invoices, or estimates related to repairs or replacements, as these will be useful when valuing the claim.Provide Accurate Information

When filing a home insurance claim, it is essential to provide accurate and detailed information about the incident. Be honest and transparent about what happened, providing a clear description of the events leading up to the damage or loss. Providing accurate information helps the insurance provider assess the claim efficiently and ensures a smoother claims process for you.

Remember, these tips can vary depending on your insurance policy and provider’s requirements. Therefore, it is always wise to familiarize yourself with your specific policy to understand the claims process better and any additional steps you may need to take.